10 firms provide 40pc of all VAT and SD

Some 40 percent of the total value-added tax and supplementary duty collected in a year by the National Board of Revenue comes from only 10 firms -- a startling detail for a $220 billion economy that is growing fast.

The companies are from cigarette, gas, mobile operator and power sectors, according to data from the Large Taxpayers' Unit, VAT.

The disclosure also suggests extensive tax evasion by others.

“This indicates that VAT and SD collection from domestic economic activities is vulnerable to the fortunes of a few institutions,” said Zahid Hussain, lead economist of the World Bank's Dhaka office.

Bangladesh has 8.5 lakh firms registered under VAT but only 32,000 submit returns and pay VAT, much to the vexation of Finance Minister AMA Muhith.

“This makes it clear that VAT is confined to a limited area,” Muhith said in his budget speech last month.

Data showed that 157 firms accounted for 55 percent of the total of Tk 56,080 crore collected as VAT and SD from domestic economic activities in fiscal 2015-16.

Of the sum, Tk 30,417 crore came from LTU-VAT, 75 percent of which, in turn, were from 10 firms.

VAT paid by the top revenue-generating firms such as British American Tobacco, Dhaka Tobacco Industries, Petrobangla, Grameenp-hone and Titas Gas stood at Tk 26,045 crore in the first 11 months of fiscal 2016-17.

-

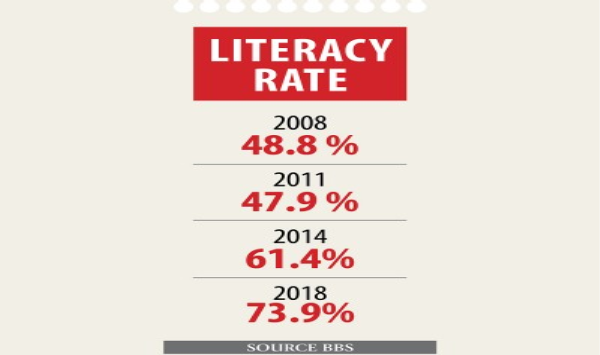

100pc literacy still a far cry ...

07 Sep, 2019 -

10 firms sued over harmful substances in milk ...

04 Aug, 2019 -

Peace and fair contest, not rivalry ...

09 Jul, 2019 -

Detergent, anti-biotics in milk ...

02 Jul, 2019 -

Left in the lurch ...

25 Jun, 2019 -

Time to work on basics ...

19 Jun, 2019 -

Japanese Dev Assistance: $2.5b for 4 projects ...

11 Jun, 2019 -

PM’s Visit to Japan: $1.2b loan deal likely for four dev projects ...

28 May, 2019 -

Road, rail blocked in Khulna, Ctg ...

20 May, 2019 -

SSC Examinations: Girls shine as pass rate rises again ...

13 May, 2019