bKash pays Tk 139cr to mobile operators as net fee in three years

Most of the mobile financial service (MFS) providers in the country use Unstructured Supplementary Service Data (USSD) channels of mobile phone operators to provide mobile banking service to the customers.

Industry insiders said most MFS providers share 7 percent of their revenue with the mobile operators under a revenue sharing model agreed by all stakeholders to access the USSD channels, a critical resource to deliver mobile financial services to low-income customers with basic handsets.

bKash, the largest MFS provider in the country said it paid around Tk 139 crore to mobile operators between 2013 and 2015 in exchange of accessing the USSD channels to providemobile money services to the customers.

bKash also shares 80 percent of its revenue with agents and distributors as commission.

Bangladesh Bank reported more than a dozen of MFS providers are having 36.5 million registered customers as of July 2016.

During the month, around Tk 17,000 crore was transacted while the average daily transaction was recorded around Tk 587 crore. The objective of launching mobile money services back in 2011 was to create financial access for the poor and unbanked via mobile phones.

Apart from sending and receiving money, mobile banking is now also used for payment at shops, mobile balance recharge, salary disbursement and receiving of inward remittances.

Zahedul Islam, spokesperson of bKash said in 2015 that bKash alone paid Tk 67 core to four mobile operators—Grameenphone, Robi, Banglalink, Airtel for using their USSD channels to provide mobile money services to the customers. The major portion of that network fee went to Grameenphone which dominates the mobile industry.

He also said bKash paid Tk. 46 crore and Tk. 26 crore respectively in 2014 and 2013 to the mobile operators in exchange of accessing the USSD channels.

“It is clearly shown that a remarkable increase of our contribution to the revenue earning of telecom operator amid the growth of mobile wallet users,” stated an industry expert.

The service providers argue that the mobile operators should provide non-discriminatory client support to the service providers who are dependent on the mobile operators’ network and the regulator should have clean visibility for measuring the satisfaction level of the service providers.

-

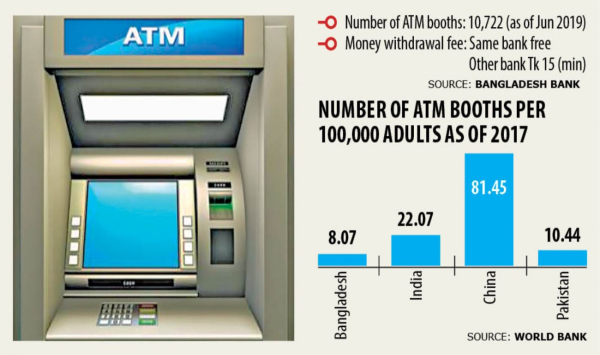

Non-bank entities can soon set up ATMs ...

08 Sep, 2019 -

Bank Asia reappoints Arfan as MD ...

04 Aug, 2019 -

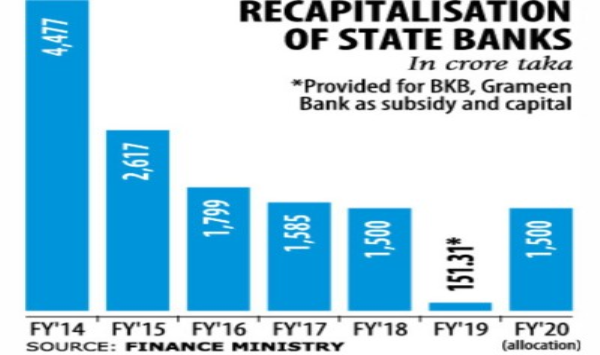

No handouts for state banks last fiscal year ...

09 Jul, 2019 -

BASIC Bank gets new MD ...

02 Jul, 2019 -

Financial discipline in banking a must: IBFB ...

25 Jun, 2019 -

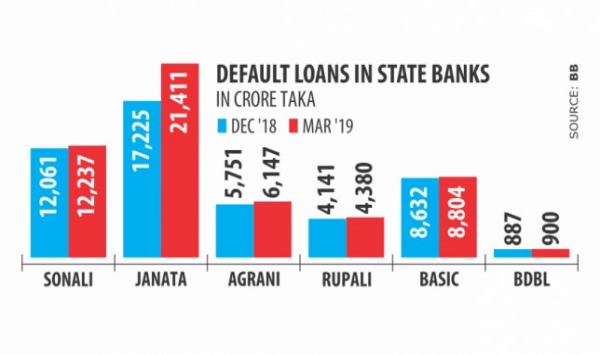

State banks weighed down by bad loans ...

19 Jun, 2019 -

Banks should be setting interest rates, not others ...

11 Jun, 2019 -

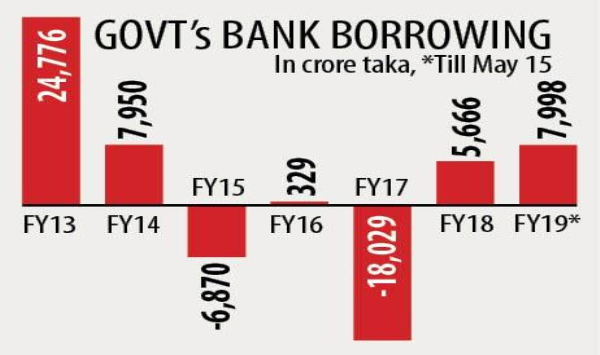

Govt’s bank borrowing hits six-year high ...

28 May, 2019 -

Bank Asia re-elects vice chairman ...

20 May, 2019 -

BB agrees to redefine banks’ stock exposure ...

13 May, 2019