Slump in interest rate on deposits worries BB

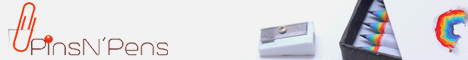

The interest rate on banks' deposit fell drastically, much to the central bank's concern.

Now, the rate of interest on savings deposit ranges from zero to 4pc; most of the banks are giving 2 to 3pc interest, according to central bank statistics.

For depositors without taxpayer identification numbers, a 15pc tax on the interest income is deducted; otherwise, the income tax rate is 10pc.

If the deposit amount is over Tk 25,000, Tk 345 is deducted as excise duty and VAT, with the amount increasing progressively.

The service charge varies from bank to bank. For instance, if a depositor has over Tk 20,000 with Agrani Bank, Tk 150 will be deducted as service charge. If the deposit amount is between Tk 1 lakh and Tk 10 lakh the service charge will be Tk 500.

If anybody has Tk 1 lakh as savings deposit with Agrani, the depositor will get Tk 900 a year after deducting taxes and all charges. If inflation is taken into account there would be no profit, said a manager of the state-owned bank on condition of anonymity.

Meanwhile, the interest rate on fixed deposit and deposit pension schemes in many banks has come down to below 6pc, which has prompted many to rush to buy government savings instruments.

Given the development, the Bangladesh Bank issued a notice to banks early this month asking them to keep the interest rate on deposit at a reasonable level.

The severe cut in interest rate on deposit is encouraging wasteful consumption as people are put off by the idea of saving.

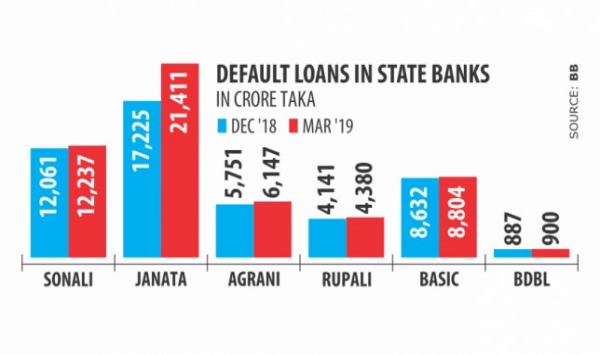

On the one hand, default loans are on the rise and on the other the businessmen's pressure to reduce the rates of interest on loans has resulted in the lowering of returns on deposits.

At the same time, banks are sitting on excess liquidity due to the low investment demand -- a development that also had a part to play in the downward trend of interest rates on deposits.

-

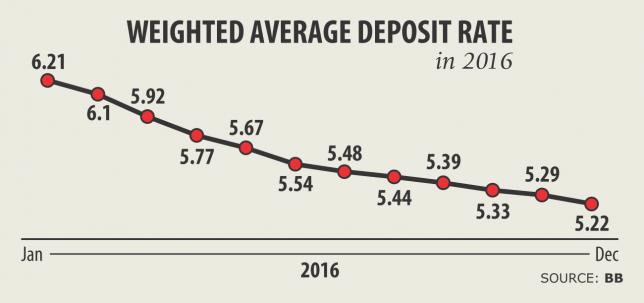

Non-bank entities can soon set up ATMs ...

08 Sep, 2019 -

Bank Asia reappoints Arfan as MD ...

04 Aug, 2019 -

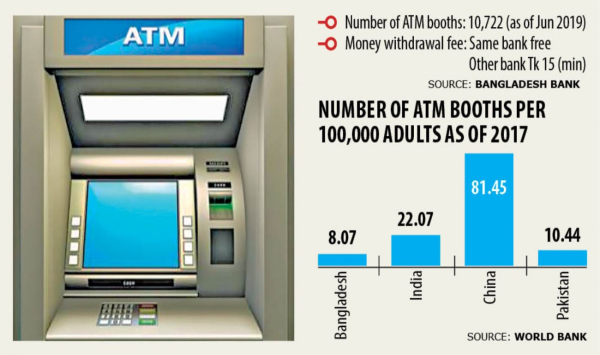

No handouts for state banks last fiscal year ...

09 Jul, 2019 -

BASIC Bank gets new MD ...

02 Jul, 2019 -

Financial discipline in banking a must: IBFB ...

25 Jun, 2019 -

State banks weighed down by bad loans ...

19 Jun, 2019 -

Banks should be setting interest rates, not others ...

11 Jun, 2019 -

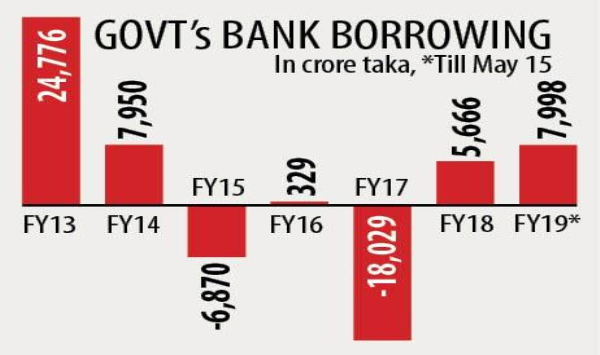

Govt’s bank borrowing hits six-year high ...

28 May, 2019 -

Bank Asia re-elects vice chairman ...

20 May, 2019 -

BB agrees to redefine banks’ stock exposure ...

13 May, 2019