Banks irked by interest rate cap on credit cards

Bangladesh Bank's decision to cap the interest rate on credit card came as a shock for the banking industry, especially those with a good exposure to this segment.

Earlier on May 11, the central bank issued a guideline on credit card operations and for the first time, set a limit on the interest rate on credit cards.

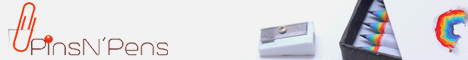

Banks can charge the highest interest rate of consumer loans plus 5 percent, meaning that the interest rate on credit cards would come down to 16-17 percent -- half the existing rate.

Currently, banks charge as high as 36 percent interest on credit card, while interest rates on consumer credit stand at 11-12 percent.

Bankers termed the BB move unrealistic and also detrimental to the country's digital vision that encourages cashless transactions.

Amid this situation, bankers called an emergency meeting last week to discuss the issue and decided to write to the BB through the Association of Bankers Bangladesh to reconsider the decision, according to Selim RF Hussain, managing director of Brac Bank.

Brac Bank is among the top 5 players in Bangladesh's credit card market with about 1 lakh cards. “We protest the move as it was taken without any discussion with banks,” he said, adding that the interest rate on credit card is 2 to 3 times higher than the average lending rate in other countries. Bankers said the interest rate of 16-17 percent is not sustainable for the credit card business.

They said they have to spend about 20 percent, such as 5 percent as cost funds, 5 percent for general provision (regulatory requirement), 5 percent for bad debt (minimum) and another 5 percent for other operating costs and promotional activities.

In addition, there are huge risks involved with credit card as it is fully collateral free.

Besides, banks have to make huge investments in infrastructure, marketing and other promotional activities for the credit card business, said Mashrur Arefin, additional managing director of City Bank.

-

Non-bank entities can soon set up ATMs ...

08 Sep, 2019 -

Bank Asia reappoints Arfan as MD ...

04 Aug, 2019 -

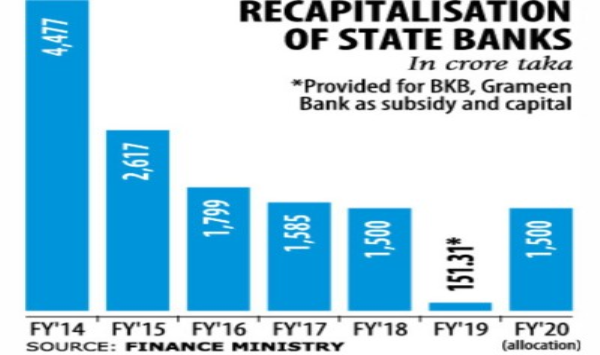

No handouts for state banks last fiscal year ...

09 Jul, 2019 -

BASIC Bank gets new MD ...

02 Jul, 2019 -

Financial discipline in banking a must: IBFB ...

25 Jun, 2019 -

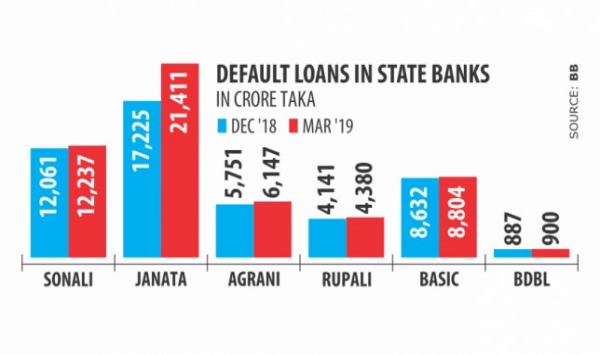

State banks weighed down by bad loans ...

19 Jun, 2019 -

Banks should be setting interest rates, not others ...

11 Jun, 2019 -

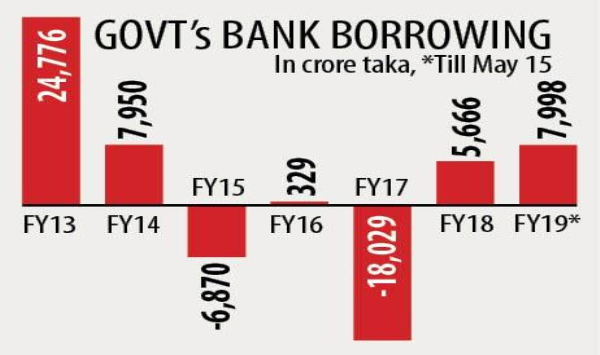

Govt’s bank borrowing hits six-year high ...

28 May, 2019 -

Bank Asia re-elects vice chairman ...

20 May, 2019 -

BB agrees to redefine banks’ stock exposure ...

13 May, 2019