A bonanza year for BRAC Bank

BRAC Bank made a remarkable come-back during the year 2016 with phenomenal figures, performing beyond expectation under its new management, led by its Managing Director & CEO, Selim R. F. Hussain.

BRAC Bank has registered a robust 83.1 per cent growth to Tk. 4.46 billion in its net profit during 2016. Total loans and advances and total assets expanded by 17.8 per cent and 10.7 per cent respectively on an annual basis. Non-performing loans as a share of the total lending fell to 4.0 per cent in 2016 as opposed to 7.0 per cent in the previous year, with the ratio of NPLs in its SME division falling to 3.7 per cent in 2016 against 7.6 per cent in 2017.

Return on Equity and Return on Assets were up by 8.84 per cent and 0.76 per cent respectively on an annual basis. Earnings Per Share rose to Tk. 6.28 in 2016, against Tk. 3.43 registered in the previous year.

"The simplification of business processes, recruitment of dedicated and dynamic talent, enhancement of employee benefits and continuous trainings have resulted in improved customer service," Mr. Selim R. F. Hussain told The FE in an interview recently.

"Core banking upgrade and ERP will go live this year and they will be instrumental in allowing us to continue building our business momentum. The new branch banking model has come into fruition where all the branches serve as distribution points to provide SME, retail and corporate banking solutions", emphasised Mr. Hussain.

Changes included a massive overhaul of the bank's senior management that brought in new and fresh perspective in almost all fronts. Abdul Kader Joaddar, having previously occupied senior positions at Standard Chartered in Singapore and Dubai, was brought in as the Deputy Managing Director and Chief Financial Officer. Chowdhury Akhthar Asif, former Head of Credit Risk Management at One Bank Limited, joined as the Deputy Managing Director and Chief Risk Officer. Tareq Refatullah Khan, former Head of Corporate Banking at Eastern Bank Limited, became the Head of Wholesale Banking. Nazmur Rahim and Bilquis Jahan joined as the Heads of Retail Banking and Human Resources respectively.

To have the whole team going in the same direction, he helped build consensus to get everyone on the same page through attractive remuneration packages, performance benchmarks and IT-driven management with the goal to become 'the best bank in Bangladesh'.

"We are the first bank in the country to disclose its quarterly financial disclosures through a live video conference where all the stakeholders joined in and made queries on the profitability, growth and business forecast of the bank," Mr. Hussain said. He said such an exposure of the bank has enhanced the image of its stock market presence, both home and abroad.

Putting emphasis on green banking, Mr. Hussain asserted that the bank does not finance any business projects that negatively impact the environment such as tobacco and ship-breaking. The bank financed around Tk 700 million in LEED-certified green industry, ETP construction, energy efficient capital machineries, fire door and fire fighting system, LED bulb manufacture, plastic recycling plant, Hoffman klin auto brick fields and bio gas plant.

The bank is overseen by an enlightened board of directors, who advise and guide the management to perform at its best in order to take the bank to greater heights.

-

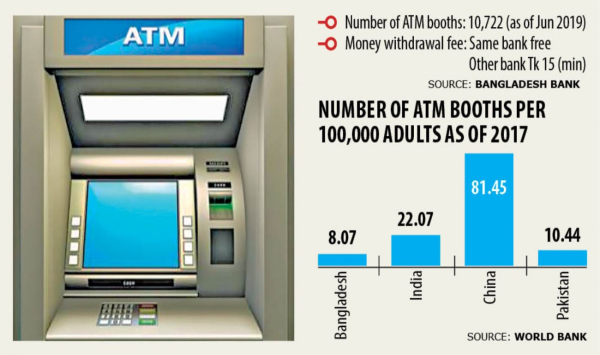

Non-bank entities can soon set up ATMs ...

08 Sep, 2019 -

Bank Asia reappoints Arfan as MD ...

04 Aug, 2019 -

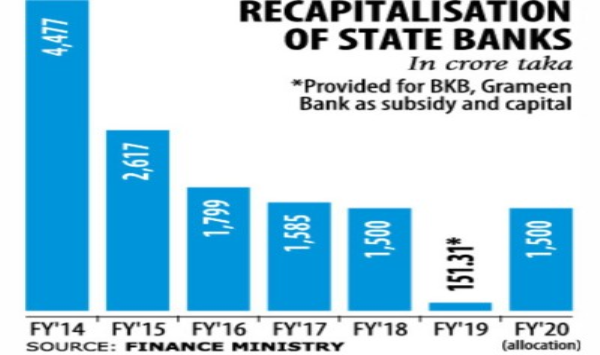

No handouts for state banks last fiscal year ...

09 Jul, 2019 -

BASIC Bank gets new MD ...

02 Jul, 2019 -

Financial discipline in banking a must: IBFB ...

25 Jun, 2019 -

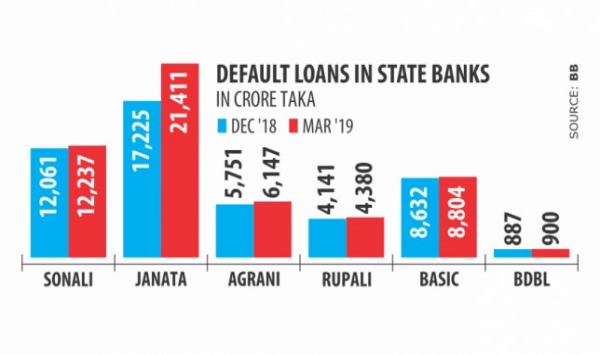

State banks weighed down by bad loans ...

19 Jun, 2019 -

Banks should be setting interest rates, not others ...

11 Jun, 2019 -

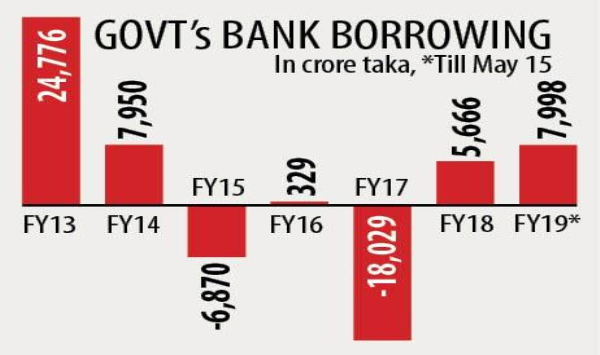

Govt’s bank borrowing hits six-year high ...

28 May, 2019 -

Bank Asia re-elects vice chairman ...

20 May, 2019 -

BB agrees to redefine banks’ stock exposure ...

13 May, 2019