Foreign capital inflow negative in 2015

Bangladesh experienced the worst ebb tide in annual capital inflows, both in equities and bonds, in the last calendar year. Low yields on bonds and comparative higher stock returns from other global equity markets were believed reasons for such slowdown in foreign fund inflows both into bond and equity markets in 2015.

The net fund inflows were negative in the past year in both the cases. The bond market saw net inflow at (minus) US$ 19.14 million and equity market at (minus) $55.57 million, according to the US-based EPFR Global. The financial agency tracks the global fund movements.

The country drew positive foreign funds in 2014 in the bonds at $8.67 million. However, the equity market saw a negative $16.25 million fund that year.

However, a number of economists conversant with the financial market told the FE that many of the foreign investors resorted to parking their money in more profitable markets in 2015, leading to fall in the investment in the local capital market.

They said the net inflow into equity market will grow this year (2016) as "cheap prices of the stocks are attracting more foreigners to invest in the local capital market".

In their view the yields on bond market in the country have been eroding over the past few years as such the investment in the market are on the decline.

Government and some financial institutions usually buy government bills and bonds. The government is borrowing less than expectation with the borrowing tools.

-

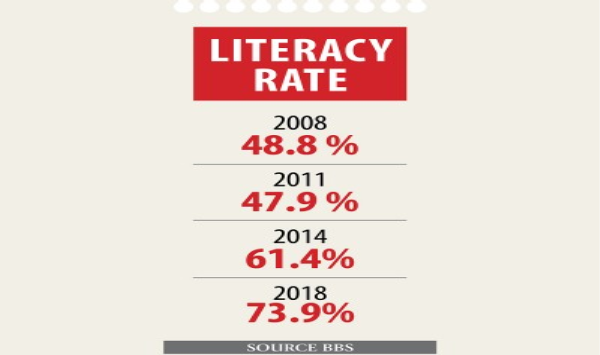

100pc literacy still a far cry ...

07 Sep, 2019 -

10 firms sued over harmful substances in milk ...

04 Aug, 2019 -

Peace and fair contest, not rivalry ...

09 Jul, 2019 -

Detergent, anti-biotics in milk ...

02 Jul, 2019 -

Left in the lurch ...

25 Jun, 2019 -

Time to work on basics ...

19 Jun, 2019 -

Japanese Dev Assistance: $2.5b for 4 projects ...

11 Jun, 2019 -

PM’s Visit to Japan: $1.2b loan deal likely for four dev projects ...

28 May, 2019 -

Road, rail blocked in Khulna, Ctg ...

20 May, 2019 -

SSC Examinations: Girls shine as pass rate rises again ...

13 May, 2019