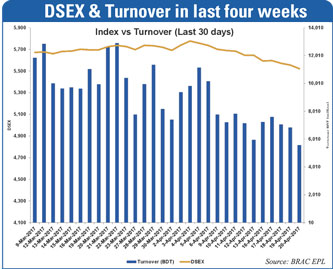

Key index, market capitalisation hit new high on main bourse

Dhaka stocks continued to break their previous records as the prime index DSEX climbs to a new high for the second consecutive session Sunday, spurred by fresh buying spree.

DSEX, the prime index of the Dhaka Stock Exchange (DSE), which replaced the DGEN in four-and-a-half-year back, continued to hold its positive momentum, adding 9.85 points more to settle at a historical high of 5,844.72 points, since its inception on January 27, 2013.

The total market cap of the DSE also rose to an all-time high of Tk 3,930 billion on the day, surpassing the previous high of Tk 3,919 billion recorded on Thursday.

Flow of new funds continued to increase as daily turnover stood at Tk 12.63 billion, an increase of 25 per cent over the previous session with textile, engineering and pharma stocks dominating the trade.

Dealers said stocks extended their record-breaking rally as investors continued to show their buying appetite on some large-cap stocks, like BATBC and GrameenPhohne (GP) which gained 2.0 per cent and 1.56 per cent respectively.

They said declining interest rate on bank deposit, possible interest cut on saving instruments, coupled with optimism of June closing year-end earnings and dividend declarations continued to prompt investors to inject fresh funds into stocks.

"The rally is intensely encouraging for investors and alluring for additional funds," said an analyst at a leading brokerage firm.

However, he advised the investors to invest carefully in a rising market and should analyse the fundamentals of securities beforehand.

The market opened with an optimistic note and the core index of the DSE rose more than 40 points within first hour trading.

Afterwards, the investors concentrated on booking short-term profits following which the index eroded most of its initial gain, finally finished ended only 9.85 points higher.

The DS30 index, comprising the blue-chips also advanced 2.21 points or 0.10 per cent to finish at 2,133.

IDLC Investment, said, "The market continued the gaining momentum adding 9.9 points to the prime index, with investors' participation was encouraging".

The merchant bank noted that textile sector maintained its lead in turnover ladder, depending on encouraging trades in Generation Next Fashions, Dragon Sweater and Simtex Industries.

-

13 sectors close higher, 6 face mild corrections ...

30 Jul, 2017 -

Dhaka stocks rebound after decline in previous week ...

30 Jul, 2017 -

Stocks rebound after choppy trading ...

25 Jul, 2017 -

Top 10 cos grab 30pc turnover on DSE ...

25 Jul, 2017 -

Prices of Z category cos rise abnormally ...

24 Jul, 2017 -

Stocks stay positive for second straight week ...

08 May, 2017 -

Weekly analysis: Stocks break two-week losing spell ...

03 May, 2017 -

Stocks tumble on selling spree ...

23 Apr, 2017 -

Stocks extend losses on profit-booking ...

11 Apr, 2017 -

Stocks extend losses on profit-booking ...

11 Apr, 2017 -

Market enters red zone as investors shift position ...

29 Mar, 2017 -

Market enters red zone as investors shift position ...

29 Mar, 2017